Urban Money: A Comprehensive Guide to Financial Growth in the City

Urban money, a term that encapsulates the various financial opportunities and strategies available in urban environments, has become increasingly significant as cities continue to grow and evolve. With urban areas being hubs of economic activity, understanding Urban Money is crucial for individuals and businesses looking to thrive in these dynamic settings. This guide explores the key aspects of urban money, including investment opportunities, financial planning, and the unique challenges faced in urban financial management.

Investment Opportunities in Urban Areas

Real Estate: Urban real estate remains one of the most lucrative investment opportunities. From residential properties to commercial spaces, the demand for real estate in cities is constantly high. Investing in urban real estate can provide substantial returns through rental income and property appreciation.

Stock Market: Cities often host major financial markets and stock exchanges. Investing in stocks, especially in companies headquartered in urban areas, can offer significant growth potential. Urban investors have the advantage of being closer to financial hubs, making it easier to access market information and resources.

Startups and Entrepreneurship: Urban areas are breeding grounds for innovation and startups. Investing in or starting a business in the city can be highly profitable. The concentration of talent, infrastructure, and market demand in urban areas creates a conducive environment for business growth.

Green Investments: With cities increasingly focusing on sustainability, green investments have gained traction. Investing in renewable energy projects, sustainable real estate, and environmentally-friendly technologies can offer both financial returns and positive environmental impact.

Financial Planning in Urban Environments

Cost of Living: Urban living comes with a higher cost of living compared to rural areas. Effective financial planning must account for housing, transportation, healthcare, and other urban expenses. Budgeting and managing expenses are critical to maintaining financial stability in the city.

Savings and Investments: Urban professionals should prioritize saving and investing to build wealth. Setting aside a portion of income for savings and investing in diversified portfolios can help mitigate financial risks and ensure long-term financial security.

Debt Management: With access to various forms of credit, urban dwellers need to manage debt wisely. High living costs can lead to increased borrowing, making it essential to manage credit card debt, student loans, and mortgages efficiently.

Retirement Planning: Given the higher expenses in urban areas, retirement planning should start early. Urban professionals should explore retirement savings plans, such as 401(k) or IRAs, and consider additional investments to ensure a comfortable retirement.

Challenges in Urban Financial Management

High Living Costs: Urban areas are known for their high cost of living, which can strain finances. Housing, transportation, and healthcare expenses are significantly higher in cities, requiring careful financial management.

Income Disparity: Urban areas often exhibit stark income disparities. While some residents earn high incomes, others may struggle with low wages. Addressing this disparity requires targeted financial strategies and policies to ensure equitable growth.

Economic Volatility: Urban economies can be more volatile due to their dependence on various industries and global markets. Economic downturns can disproportionately affect urban dwellers, making it essential to have a financial safety net.

Access to Financial Services: While urban areas generally offer better access to financial services, disparities still exist. Ensuring that all residents have access to banking, investment, and financial planning services is crucial for inclusive growth.

Leveraging Urban Money for Growth

Education and Skill Development: Investing in education and skill development is vital for leveraging urban money. Higher education and professional skills can lead to better job opportunities and higher incomes in urban areas.

Networking and Collaboration: Urban areas provide ample opportunities for networking and collaboration. Building a strong professional network can open doors to investment opportunities, partnerships, and career growth.

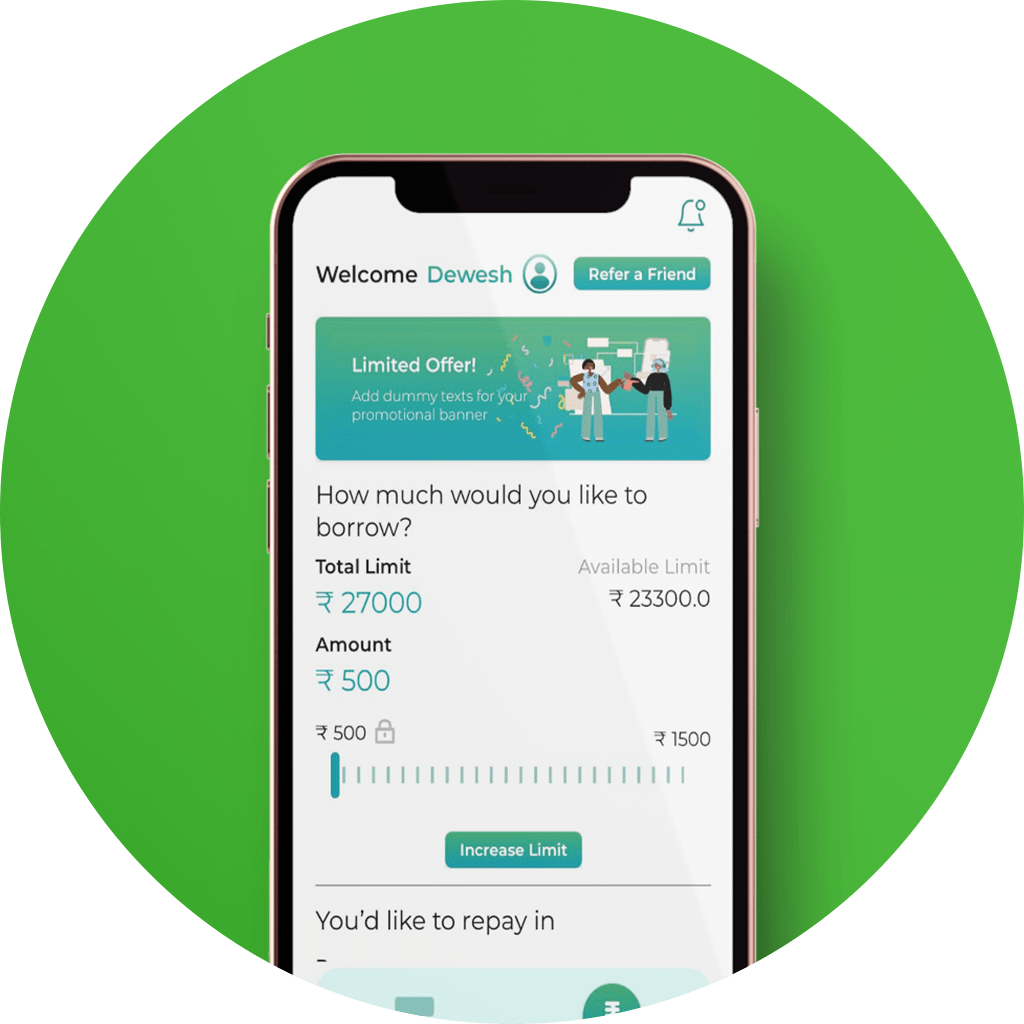

Utilizing Technology: Technology plays a significant role in urban financial management. Utilizing financial apps, online investment platforms, and digital banking services can enhance financial planning and investment efficiency.

Community Engagement: Engaging with the local community and participating in urban development initiatives can create a positive impact and foster economic growth. Supporting local businesses and community projects can contribute to the overall prosperity of the city.

Conclusion

Urban money encompasses the diverse financial opportunities and challenges inherent in city living. By understanding and leveraging these opportunities, urban dwellers can achieve financial growth and stability. Effective financial planning, prudent investments, and strategic management of urban money can lead to a prosperous and fulfilling life in the city. Whether you are an individual, a business owner, or an investor, navigating the urban financial landscape with informed decisions and proactive strategies is key to thriving in today's dynamic urban environments.

For more info. Visit us:

Post a comment